If you want to make a big cash withdrawal from Cash App you must know how much the withdrawal fee will be. The additional fee is always something users would love to go around therefore many of you must be wondering if the cash-out can be made completely free.

10 Best Fashion Apps Best Fashion Apps Fashion App Apps For Girls

Typically Cash App ATM withdrawals charge 2.

. BPI and UnionBank Cash-In in the app. When using Cash App you are initially able to. However if you need to withdraw 100 dollars in the short term the service charges a minimum fee of 025.

The Cash App weekly limit reset doesnt occur on specific days or at specific times but it should happen a. If you transfer someone 200 using the Cash App and your. 1 of the total cash-in amount.

Cash App offers standard deposits to your bank account and Instant Deposits to your linked debit card. When you use your debit card or bank account to make a payment Cash App does not charge you any fees. As mentioned earlier the Cash App itself does not charge you any fee for investing in the stocks.

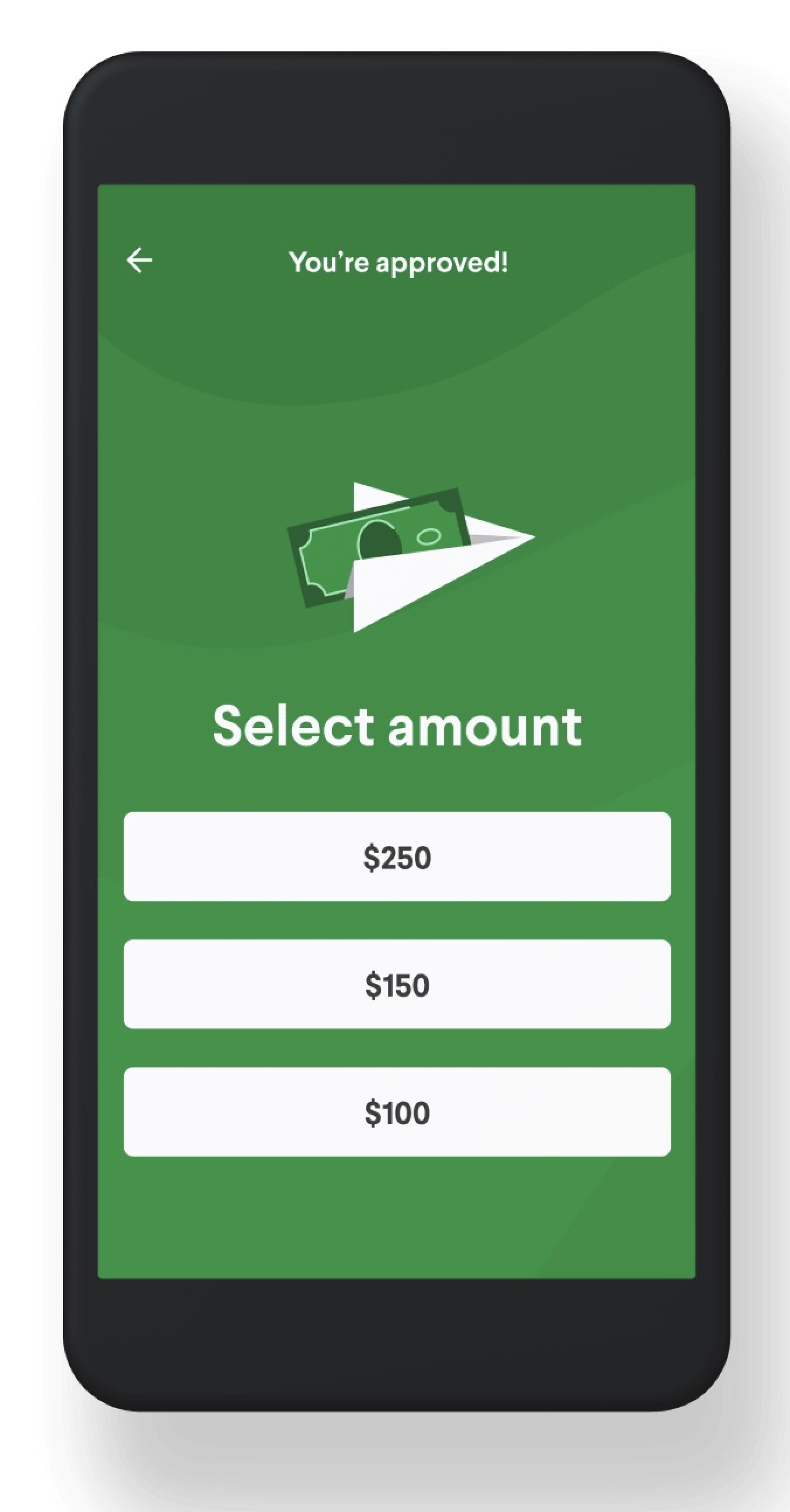

If you choose the Standard Cash Out option youll pay just 325. If you successfully go through Cash Apps verification process you should be able to send up to 7500 per week and up to 17500 per month. If you receive 600 or more payments for goods and services through a third-party payment network such as Venmo or CashApp these payments will now be reported to the IRS.

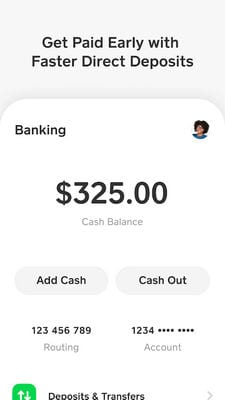

The fee for Cash App transactions varies depending on the type of account and the transaction. Cashing in via Bank Card MastercardVisa will now incur a convenience fee of 258 starting July 6 2020. Send up to 250 per 7 consecutive days Receive up to 500 per 7 consecutive days Hold a stored balance of 500 total If you send or receive more than the limit you will be prompted to verify your account with your full name date of birth and address in order to keep Cash App secure.

If you want to withdraw more than 500 youll pay 18. If you need the money right away however youll have to pay the fee of 15 of the amount. Cash App charges three percent on all credit card payments but not on bank account or debit card payments.

How Much Does Cash App Charge You to Send 200. If you choose instant. PesoNet Send Bank to Bank Transfer from banks where there is no fee.

Instant Deposits are subject to a 05 -175 fee with a minimum fee of 025 and arrive instantly to your debit card. But if you become a verified user you can up your spending limit to 7500 in a week with no restrictions on how much money you receive. How much does Cash App charge for a hundred transactions.

This fee is waived for Standard withdrawals and applies to Instant withdrawals as well. There are several options for checking your balance by phone online or via customer care. If you only use Cash App to make one or two withdrawals a month.

The new fee is due to direct charges from the mobile apps payment partners and is not part of GCash earnings. 29 percent 03 percent is the fee for every transaction. The cash app charges a fee of 025 for each transaction or 150 for a standard transaction.

The fee will also be charged on top of the amount you cash in. The fee may be higher if you use ATMs other than your own network. Using the calculator will help you estimate how much each payment will cost you.

The fee is the only downside. To get the exact. For Instant Transfer a 15 percent fee with a minimum fee of 025 and a maximum fee of 15 is deducted from the amount of each transfer.

The standard transfer takes two to three days. If you are not a verified Cash App user you can only send and receive 250. You will pay just 15 percent fee on bank account deposits.

To withdraw money from Cash App youll need to pay the service a fee. Theres no minimum amount. While Cash App doesnt officially state how much money you can borrow it says that you can transfer up to 2000 per week between different Cash Cards.

Standard deposits are free and arrive within 1-3 business days. Also keep in mind that Cash App imposes a daily withdrawal limit of 500 on unverified accounts. For every 100 you withdraw youll be charged 150.

You can also use your Cash App account to invest in stocks and Bitcoins. Instapay Send Bank to Bank Transfer from banks where there is no fee. Of course you can extend this limit depending on the type of loan you have initiated.

This fee applies first then if applicable fees for over-the-counter cash-in apply next. It is a regulatory fee of two categories SEC Fee and TAC Fee. How Much Does Cash App Charge For 600 Instant.

However a government fee might imply all the trading you wish to do through the Cash App platform. Every time you use your credit card to send money Cash App will charge you a 3 fee. For example if youre cashing in Php 100 via Bank Card the total amount that will be deducted.

Within a 7-day period you can transfer up to 20000 to your debit card or bank account. You can make use of free ATM withdrawal if you have got 300 deposited in your Cash App. If you want to cash out 600 instant funds from Cash App the minimum amount is 025.

You will need to have a minimum balance of 500 to qualify for Cash. SEC fee is 00002210 per 100 of principal and TAC fee is 0000119 per share. On top of that you can only maintain one.

How The Cash App Scam Actually Works In Detail And How To Avoid Scammers

Google Play Store Adds Wallet Rival Paypal As A Payments Option Techcrunch

The Hidden Costs Behind The Cash Advance App Dave Los Angeles Times

7 Cash Apps That Accept Prepaid Cards Android Ios Free Apps For Android And Ios

Ios 14 400 App Icons Lavender Aesthetic Icons Pack Minimalistic Apple Icons Pack Big Pack Purple Pink Lilac

Minimalist Light Grey Iphone Ios 14 Ios 15 App Icons Pack Grey Aesthetic Icon Grey App Icon Gray Theme Wallpaper Home Screen Widget

0 comments

Post a Comment